High-Tech Crossover Links Semiconductor Boom to Machine Tools

Think semiconductor manufacturing doesn’t impact aerospace, medical, energy and other seemingly unrelated sectors? Think again.

Think semiconductor manufacturing doesn’t impact aerospace, medical, energy and other seemingly unrelated sectors? Think again.

Since the U.S. government introduced a $280 billion plan to reshore semiconductor manufacturing two years ago, the industry has been pushing to develop new materials and refine production systems.

One example comes from Ithaca, New York-based Odyssey Semiconductor, which has developed a high-performance gallium nitride (GaN) semiconductor material that takes “up to 10 times less wafer area” than its silicon and silicon carbide counterparts.

Similarly, SixLine Semiconductor of Madison, Wisconsin, is producing carbon nanotubes that it claims are “nature’s perfect transistor material.” Both companies (and many others) are delivering breakthrough technologies that promise to change consumer electronics, electric vehicles, industrial power grids and much more.

In short, the chipmaking industry is undergoing a sea change, one that could bring profound improvements to other industry segments as well. It’s that whole “rising tide lifts all boats” thing.

Granted, none of these materials are going to show up on a typical production floor unless your business has a cleanroom and specializes in photolithography, etching, doping, die preparation, packaging and the other esoteric steps involved in the highly complex semiconductor manufacturing process.

So machinists reading this might think, “That all sounds cool, but how does this pertain to me and my job?”

Great question. As you’ll see, many of the companies that provide equipment to the semiconductor industry also support machine shops and sheet metal fabricators with similar technology, albeit for different purposes.

Machine tool probing and metal 3D printing supplier Renishaw, for instance, produces a range of process control and quality assurance devices, among them its inVia brand of confocal Raman spectroscopy instruments, used to analyze the chemical composition of wafers, thin film thickness, dopant concentrations and other critical characteristics that affect product quality.

Perhaps more relevant to the shop floor is Renishaw’s Resolute line of absolute encoders. As product manager Eirik Scott explains, the high-resolution encoders have enjoyed widespread use in wafer-handling robots and other material-handling systems for the past two decades, a trend that shows no sign of slowing.

“There’s nothing else out there like it,” he says.

At the opposite end of the semiconductor manufacturing process sit laser marking products from Tykma Electrox. Typically integrated directly into the production line, fiber lasers are used to engrave chips and wafers alike with part numbers, lot and date codes and other information needed for identification and traceability. They can do so in seconds.

“We offer a broad range of laser marking solutions, including fiber, CO2 and ultraviolet,” says Southeast Regional Sales Manager Terence Dineen. “Each has its strengths, but fiber lasers have long been our go-to solution, both in the semiconductor market as well as many other segments of the manufacturing world, machining among them.”

Other solution providers that straddle both sides of the manufacturing fence include:

Mitutoyo: The well-known metrology company offers vision machines, microscopes, coordinate measuring machines (CMMs), and laser measurement systems that are just as suitable for the machine shop as they are for electronics and semiconductor manufacturing. And as with machining, data collection and statistical process control are equally important when making chips—metal or silicon—both of which are supported via Mitutoyo’s MeasurLink software.

Zeiss: CMMs and optical 3D metrology equipment from Zeiss are also common fixtures in many manufacturing facilities, chipmaking included. Yet the company’s 7,500-strong Semiconductor Manufacturing Technology team goes even further, supporting the industry with advanced optics, photomask equipment, CT scanning and 3D tomography systems as well as scanning electron microscope (MultiSEM) technology that “enables unique insights and analyses” into brain research and microchip production alike.

Kyocera: Many machinists associate the name Kyocera with circuit board drills, a low-cost, highly effective solution for many small-hole drilling operations. And subsidiary Kyocera SGS Precision Tools takes that one step further with its line of indexable turning and milling inserts, carbide end mills and drills, router bits and custom tools. But Kyocera Global is an even bigger player in the electronics market, producing a broad assortment of capacitors, connectors, camera modules and power semiconductor devices, to name a few.

Siemens: It goes without saying that robust, highly integrated software systems are increasingly important to manufacturers, whatever they produce. Siemens Digital Industries Software, the developer of NX, Solid Edge, Opcenter and other platforms notes on its website that “modern electronics manufacturing has many challenges: supply chain uncertainty, longer lead times, and the increasing costs of materials and components that change by the minute.” And while that’s certainly true, it’s not a stretch to eliminate the word “electronics” from the statement, reinforcing the need for all manufacturers to invest in advanced software to control, collaborate, monitor, organize and analyze every aspect of the production process.

Similar overlaps between semiconductor production and machining exist. For instance, Mazak and Makino might disagree on which machine tool brand is better, but they’ll both tell you that semiconductor manufacturers demand extreme precision and reliability from their equipment, tooling and fixtures. Without the right CNC machinery, these attributes are difficult to deliver.

Hardinge takes that one step further, designing special machine tools to grind, mill and drill wafers, electrodes, rings, chucks and domes made from advanced ceramic materials like single or multicrystal silicon, alumina (Al2O3 ), aluminum nitride (AlN), silicon nitride (Si3N4), and silicon carbide (SiC).

Robotics and machine tool control giant FANUC is every bit as interested in automating semiconductor fabrication facilities as it is job shops and other discrete manufacturers. So are its competitors.

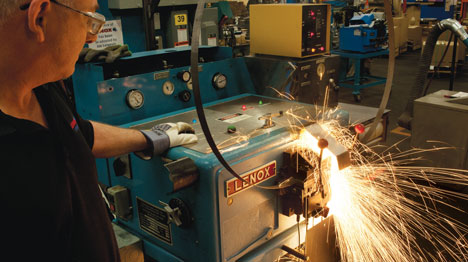

And while you might be using 3M Scotch-Brite pads or Cubitron grinding wheels in your workplace, the Minnesota-based company also has a broad portfolio of solutions including EMI/RFI management, thermal management, vibration damping, processing tapes and adhesives, abrasives and connector solutions.

The interest these companies and others show in semiconductor manufacturing illustrates that it’s not only big business, but it’s also poised to grow exponentially as the full impact of the $280 billion CHIPS and Science Act is felt.

For machine shops looking to jump on the silicon bandwagon, checking out the products above might be an excellent place to start.

![Abrasive Selection Guide: Choosing the Right Grinding and Finishing Solutions [Infographic]](https://images.ctfassets.net/5j4ln2up7bt7/1PP33ignTLl0VM0awoD294/e585b6ab26bf3bf71e34aa622fcf3437/GettyImages-905155112_Image3-thumb.jpg)