The Future of Metalworking Fluids, Machine Lubricants and Coolants

Projected to be a $15 billion market by 2025, the metalworking fluids industry is in a constant state of adaptation to regulations and reducing product use.

Projected to be a $15 billion market by 2025, the metalworking fluids industry is in a constant state of adaptation to regulations and reducing product use.

What will the future bring to coolants, lubricants and metalworking fluids? We talked to industry veterans to better understand the evolution of today’s coolant landscape and tomorrow’s innovations.

What’s new and next for metalworking fluids? It depends on a few essential conditions: What material is being cut? What are the regulations and localized needs governing MWFs at the time they are being used? And, what innovations in tooling and in manufacturing overall will take root that might change the very nature of cooling?

From a market perspective, the metalworking fluids market is expected to grow globally to $15 billion by 2025, according to Global Market Insights, a research firm and consultancy. In 2016, Markets and Markets Research estimated that the MWF market would be $9.74 billion by 2020 at a compound annual growth rate of 3.2 percent.

For many metals being cut, such as steel and iron, lubricity—with water or oil (or both)—matters to removing chip debris, and additives help to keep metals from deforming and to avoid rust—and these fluids help cool surface temperatures and maintain tool life. Yet, health and safety concerns arise whenever MWFs are in play, so fluid-makers are consistently adjusting and readjusting their formulations and chemical makeups to help maximize performance and minimize waste. Customers want to be able to recycle coolants to cut down on costs—and they also want already used coolant to live in the sump as long as possible without causing any health problems.

It’s not an easy task. The biggest health issue across the board is skin irritation—something all the makers work to help avoid, but the right systems, such as mist collectors, and protective equipment, such as gloves, eye protection and face masks, also have to be used, find the fluid-makers.

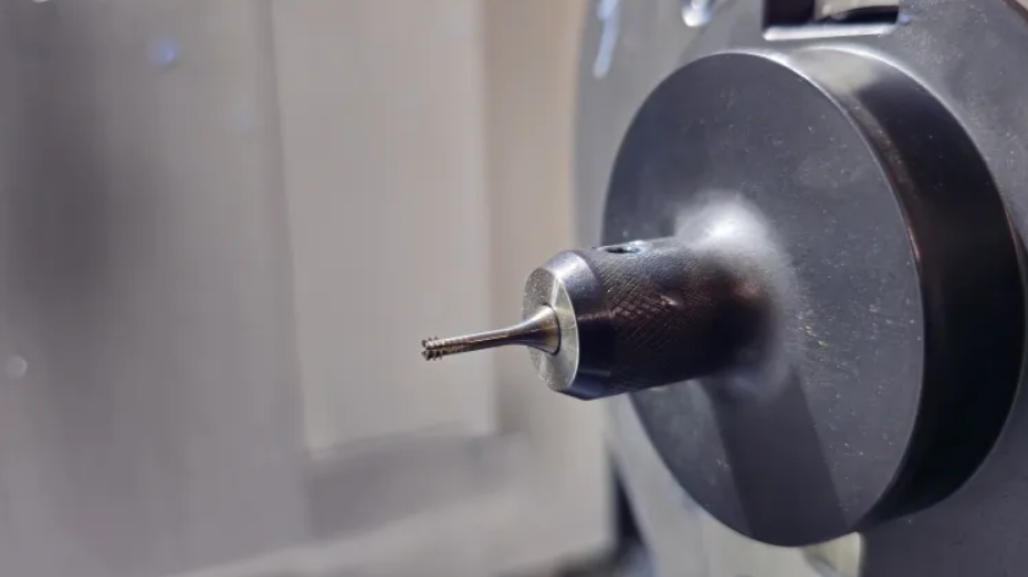

Innovation is happening by balancing part-making performance needs with desired healthy outcomes. It’s becoming easier to meet these needs, but it’s been a long road to get there. There’s the move toward minimum quantity lubrication—which is exactly what it sounds like: Use the least amount of lubricity with the least amount of chemicals, additives and emulsifiers. The worry and concern about other chemical-based health issues have many regulators and entire regions often banning the use of certain chemicals altogether.

On the horizon, there are distant, years-to-come murmurs of fluids perhaps becoming obsolete. There’s still a long way to go before that happens, but it’s enough that the companies interviewed are aware of the possibility—as are research analysts who watch the market.

Are the hazards associated with MWFs as dangerous as some regulators believe they can be? The fluid-makers interviewed greatly empathize with the health and safety concerns but concur that they go overboard to address them.

As technology helped to speed up machining and the pressure to make parts more quickly took hold, there was a eureka moment, says Bruce Koehler, senior product manager at Milacron’s Cimcool Fluid Technology: It was discovered that water reduces heat more so than straight oil. And straight oil burns and water doesn’t.

“We’ve moved from just using oil to using water and oil or using only water by itself,” says Koehler. Today, there are less MWFs being used than there used to be. “The list of chemicals to use in metalworking fluids is getting shorter and shorter based on safety and health issues. ”

Many manufacturers have moved from having 10,000-gallon sump systems that would serve 50 machines to using 50-gallon sumps per machine within a five-machine cell. Also, the formulations and chemistry compounds are always changing based on issues such as raw material availability and the localized needs of customers.

“There’s a lot of chemistry reformulation happening and being able to adjust on the fly due to regulations and local needs,” says Koehler. “From a formulation standpoint, sometimes your chemistry is a byproduct of a process.”

Thirty years ago, synthetic fluids got a bad name for the aggressive residues they used to leave behind—and the residues were extremely tacky, and they’d damage paint and other parts on the machine. Not as much anymore, claim the experts.

“We’ve come a long way, in the last 13 years or so that I’ve been here, in developing many semisynthetic fluids to improve biostability, emulsion stability, and improve sump life and performance,” says Brian Halstead, application engineer at Castrol Industrial. “For us, our goal is to reduce use, reduce waste and improve health and safety.”

All the ancillary technologies used with coolants—such as medium- and high-pressure coolant systems, sumps, skimmers and filtration systems—those have all influenced the use and maintenance of MWFs.

“When I started (36 years ago), the normal pressure coming out of a spindle where the fluid comes out of a tank and goes to the work zone was at maximum, 300 psi,” says Koehler. “Now we’re talking about pressures where the material’s being worked up to 1,200 psi: That’s four times the pressure.”

Need guidance on coolant maintenance and disposal? Read “4 Tips to Optimize Machine Fluid Maintenance and Coolant Disposal.”

As less and less chemical additives are being used, it means water quality and makeup has become another key factor in how coolant performs and its chemistry. “Indiana is known for its hard water, while Kentucky’s water is soft, for example,” says Koehler. So you’re always dealing with a variety of conditions that change what’s happening in a machine and the elements that might be introduced by the specific water that’s available to a manufacturer’s locale. The formulations have to change according to the water supply.

But additives, emulsifiers and lubricant qualities in coolant are still needed. In the automotive, aerospace and medical parts machining world, the trend is toward using stronger materials that are lighter in weight. High-temperature alloys and chromes are running faster and increasing the heat in the machining operation—and the best way to remove heat from the operation is with synthetic fluids that help the lubricity so that cuts can be made easier—especially with harder materials.

In aerospace, in particular, oil-containing products are still used, but they’re being diluted by 90 to 95 percent water. The industry is moving from 6000 series aluminum to titanium—which tends to work better with synthetic fluids, says Koehler.

“What I love about synthetics is their sump life—they don’t grow bacteria very well,” says Koehler. “They last a long time from a biological standpoint. They don’t foam. And they stay clear, so a machine operator can close the machine door and look in and watch the cut without any visual interruptions.”

An important element in the direction and future of coolant and coolant systems resides in the material and its application. Much of the material that will be used in the future is not necessarily known to fluid-makers—as much as it’s known to manufacturers. But that isn’t stopping the makers from trying to innovate toward a waste-free product line.

“We have an area we call ‘congruent chemistry’ that for water-based fluids is serving a dual purpose that is also a cleaner that washes the parts and helps the sump maintenance by making all the elements in the coolant compatible,” says Halstead.

The kicker? There’s no need to skim oil at all; the waste is only when you go to change the system. Castrol Industrial claims it is seeing some 40 percent reduction in product usage with some product lines from older fluid technologies.

Koehler says an area Milacron Cimcool has been keeping a close eye on is nanotechnology, where microscopic solid, nanoparticles could be used to lubricate instead of water-based fluid as it is today. While there is the potential for promise here, there is not enough research yet on how it might affect an operator’s lungs—so it’s still a wait-and-see approach, admits Koehler.

“We are also trying to improve the wetting properties in water-based coolants, so it sheets off of parts in machines better, leaving less residue behind and improving the life in the sump,” says Halstead. “We are also improving on concentration stability, so if you’re using less, you’ll need the concentration to maintain and stabilize, and not deplete and not need more to make up the difference.”

But ultimately, the major fluid-maker is trying to simply do one thing: Create global product stability that can be used worldwide, then localized for the needs of customers. The challenge then is to take the knowledge built up from testing and optimizing coolants to then work with local and regional laws and water quality conditions to help customize to those needs.

To stay on top of inevitable material shifts, the major fluid players work with their customer partners at their plants and also perform testing in their labs on today’s machining centers in as close to real-world conditions as possible. Some work directly with their customers and prospects on patent pending materials—to test new coolant formulas or to work with new metal materials and experiment with what works.

Castrol Industrial, for example, works with General Electric in Greenville, South Carolina, where the fluid-maker is exposed to patent pending aerospace materials being developed. Castrol also works with Ford Motor Company—and other automakers, such as GM and Toyota, on a number of fluid applications.

Chlorine, DCHA (or dicyclohexylamine) and boron are being removed from coolants by fluid-makers. Chlorine is often used to kill bacteria but can be dangerous to lungs and skin. DCHA, which is a “secondary amine,” is used as a pH-stabilizer, but as more recent studies have found, dangerous exposure to it can occur through the skin. So, many secondary amines are being eliminated from coolant formulas, say fluid-makers. By only going with the primary amine, you have fewer chemicals in the product, so there is less chance for causing skin irritations and other health issues.

Why? Because boron at certain levels can build up residues and be detrimental to tools by adhering to parts, spindles, conveyors and cutting tools, which can deplete tool life performance, says Halstead. Castrol Industrial found this out through testing on CNC machines in labs with metal cutting tools and coatings. As an anti-corrosive chemical, boron helps, but at higher concentration levels, it can be dangerous, which is first and foremost on the company’s agenda.

There’s good and bad with the boron properties, says Halstead. “Boron has the pH buffering and a stabilizing effect, and the rust protection, or ‘RP,’ which is often viewed positively.” But even at low levels where coolant waste is staying in the sump longer and longer, it will concentrate over time, so some companies want it eliminated altogether.

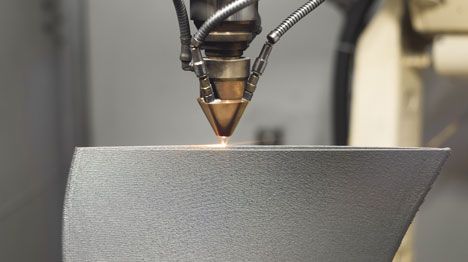

With the rise of dry machining techniques and additive manufacturing processes that do not need to use coolant, the MWF business is facing some long-term potential competition—including from tooling-makers. In addition, environmental and health concerns have many regulators forcing manufacturers to move toward using the minimum quantity of lubrication, also known as MQL.

“Increasing concerns over the environmental impact of lubricants, coupled with success in dry machining at temperatures up to 1,800 degrees Fahrenheit, are driving this trend,” writes Aaron Stone for Fuels & Lubes International. “The emergence of advanced ceramic and diamond, and cubic boron nitride tooling, has enabled high temperature machining with limited or zero lubrication, without generating excessive wear.”

Regardless of the industry’s ultimate direction, fluid-makers agree on one thing: The concentrations of the fluids are intended to be used at 5 to 10 percent.

“It’ll be the same when I retire as it was when I started,” says Koehler. “Everyone always thinks more is better or wants to save money and use less … If you run at 3 percent, you’ll have biological concerns, mold growth and corrosion, and if you use it too rich, we’re talking about skin irritation or foam. It’s the one consistent thing in this business.”

His advice? Keep it clean and keep the concentration where it needs to be and you’re going to have a successful metalworking fluid operation.

What metalworking fluids do you use? Where do you see the future of these products headed? Share your thoughts.

Customers want it and coolant manufacturers, while it’s not a primary point of business, recognize the value of recycled fluids—and understand how to help. Recycling of MWFs can save customers money—with some estimates showing a “potential 8% volume reduction against a non-recycling system,” according to John Burke, STLE Fellow and global director of engineering at Houghton International—as reported by Fuels & Lubes International.

“Recycling goes right along with our goal of reduced product use and waste,” says Brian Halstead of Castrol Industrial. “We do best practice transfer from our other customer sites where we have helped them implement successful recycling programs and equipment. But we do not sell such equipment, so we help them either find an OEM that can supply what is needed or we help design something with the customer that they can build.”

All types of recycling have a single goal in mind: To extend the life of the fluid, and there are a variety of methods that are used, all which have good and bad aspects, explains Bruce Koehler, of Milacron’s Cimcool brand. “Obviously it starts with filtration at the sump, and the removal of all the chips via paper filter, bag filters, etc. Recycling goes beyond this as many customers use oil wheels, belt skimmers, rope skimmers to remove floating oil—with many using centrifuge units to ‘spin’ out tramp oils and chips.”

But recycled fluids do not last forever. The goal is to help make fluids last a long time, but there is a life span.

“Sometimes fluids should just be dumped and recharged, period,” says Koehler. “There is the quality of the water you are using, as certain ions build up, like chlorides or calcium that you cannot overcome.”