The challenge of improving cycle time in machine and cutting operations often has machinists searching for new solutions. Here’s how shops are dealing with large volumes, strict process controls and the high quality that the automotive industry requires.

There’s a vision associated with automotive machining, one that includes dedicated machine tools cranking out steel and cast-iron parts by the gazillions.

That vision has changed somewhat over the past decade or so as automakers and their suppliers have moved to flexible manufacturing systems and advanced materials.

But the fact remains that production quantities are significantly higher in automotive than in other industries.

Shops wishing to pursue such work had best have their pencils extremely sharp, their quality assurance levels in pristine order, their on-time delivery records just that—on time—and on top of all that, be prepared to shave a few percentage points off their piece price each year.

To achieve all that requires—among other things—the right cutting tools, along with the application knowledge necessary to achieve the shortest cycle times and best tool life possible.

Keeping Your Cutting Tools Consistent

This knowledge is valuable for any manufacturer, even those who specialize in the high-mix, low-volume work typical of most job shops. The question then becomes: What are those cutting tools, and what attributes do they have that separates them from more general-purpose tooling?

Adam Glover, district manager at OSG USA Inc., explains that high-volume manufacturers look for consistency in their drills and end mills rather than any specific geometry, grade or coating.

“The design and machining characteristics of automotive tooling will be quite similar to that used by job shops, but when you’re running a million a year of something, you can’t tolerate any surprises,” Glover says.

“You need predictable tool life, and when it’s time to change a drill or other round tool—or any cutter, for that matter—you want to put it in and hit cycle start,” he adds. “That’s the top priority, which is why automakers always select the highest-quality tools available, regardless of price.”

Balancing the Budget

But hold on—anyone who’s quoted machined parts for the automotive industry knows that the purchase order usually goes to the supplier that can offer the lowest piece price. Doesn’t that then suggest that shops should be frugal when planning their tooling budgets? Not really, says Brent Marsh, business development manager for the North American automotive area at Sandvik Coromant Inc.

“The repetitive nature of high-volume automotive machining demands that variation in the processes, the machine tools, the workholding, the gages, and especially the cutting tools be kept to a minimum over a longer period,” Marsh says.

“Everything requires good process capability, with less dependence on the operators manually intervening in order to achieve the desired final results,” he adds. “It’s these factors that determine the lowest piece price no matter what you’re machining.”

That’s all well and good for automakers with their affinity for cast iron, steel and aluminum, but what about everyone else? Job shops machine everything from stainless steel to Inconel, composites to high-strength alloys. Predictability is certainly important here as well, but paying a premium price for premium round tooling might be less palatable given the need for more frequent changeovers—in this environment, cutting tools are sometimes used for a fraction of their potential tool life and then set on the shelf or in a machinist’s toolbox. Is premium tooling still worth it?

READ MORE: Learn the differences between cycle time and takt time.

Moving Beyond Cast Iron

Chad Hefflinger thinks it is. A senior applications engineer at Kennametal Inc., he specializes in polycrystalline diamond (PCD) and polycrystalline cubic boron nitride (PCBN) tooling, and he spends much of his time supporting original equipment manufacturers (OEMs) and Tier I automotive suppliers.

Hefflinger agrees that the lowest cost per part is often delivered with the most expensive cutting tools.

“Due to the longevity these tools offer and the demanding nature of automotive work, it’s very easy to justify the higher cost of PCD and PCBN,” he says.

But don’t forget carbide, Hefflinger adds. While PCD tooling is commonly used to mill and bore cast aluminum engine blocks, heads and transmission housings, and PCBN is a go-to for cast iron and hardened steel components, carbide remains a popular choice for some of the newer materials, including compacted graphite iron (CGI) and high-strength alloy steels, both of which are seeing increased use in the automotive space.

OSG’s Adam Glover notes that stainless steel and other alloys are on the rise, too, and that carbide still reigns supreme for anyone machining these metals.

“I work with four shops that make fuel rail components, which are usually 316 stainless, but I also see 304 stainless, 2205 duplex, 4140 and 8620 alloy steels—it’s pretty much across the board,” he says. “We are even seeing some composite use, as with the inside frame for the bumper on the new Corvette. Whatever automakers are machining, though, the requirements are basically the same—long tool life, high productivity and consistent quality.”

When Seconds Count

Each of the experts interviewed for this article say custom tools are quite common in automotive applications.

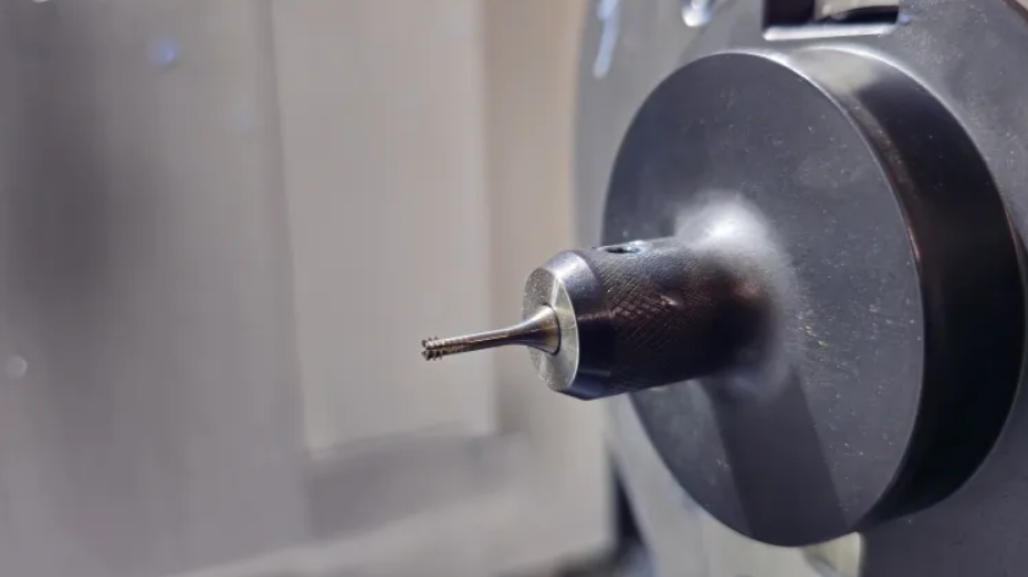

“We see a lot of call for the adjustable blade-style reamers used in superfinishing applications, combination step drills and porting tools, veined PCD cutters and a host of other custom solutions,” says Brent Marsh of Sandvik Coromant. “Seconds count in this environment, so automakers will do whatever it takes to deliver the shortest cycle time, which in turn leads to the lowest cost per part.”

Kennametal’s Hefflinger seconds that last point, adding one caveat: “It’s highly specialized, true, but there are also some commonalities,” he says. “Every engine has intake and exhaust manifolds, fuel injection ports, spark plug holes—those are all excellent applications for custom drills and reamers because the same tool designs can be used across many different part numbers.”

All this is good for automakers, but what does it mean for shops that aren’t making millions of parts per year? Maybe nothing, except for one thing: The engineers who work at Ford, Chevy, GM and all the rest know that job one in any manufacturing process is to develop the most stable process possible.

Surprises are a killer, they’ll tell you, and the best way to avoid the resulting production delays and quality problems is to buy the highest-quality tooling available, regardless of the part quantity or material machined.

What challenges have you faced when machining automotive materials? What unique solutions have you found?

A Trend Toward Hyper-Cubing

“Done in one” is a well-known motto for machine tool manufacturers that has become quite popular over recent years as the industry has pushed to complete parts in a single handling.

So it might come as a surprise that this worthy goal has been set aside by some automakers in favor of “cubing” or even “hyper-cubing,” where large components are rough machined by an outside supplier and then finished in-house.

Kennametal Senior Applications Engineer Chad Hefflinger explains: “OEMs, in general, are focusing more on machining their most critical components in-house and subcontracting the rest to their tier suppliers,” he says.

“On larger components such as engine blocks and transmission housings, they’ll even go so far as having their supplier—usually the casting house—square up the casting, machine noncritical holes and surfaces, and rough machine everything else,” he adds. “This is called hyper-cubing, a practice that allows automakers to maximize their machine tool investment, increase throughput and maintain a higher level of control over part quality.”

Related Articles

Collets Explained: A Guide to Types, Applications and Proper Selection

Zero Scrap and Performance Upgrade

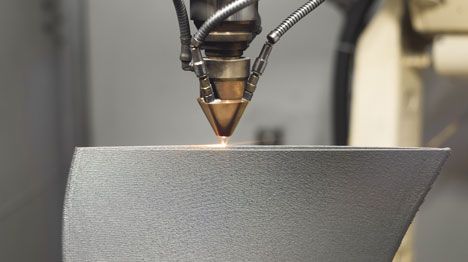

The Latest Tools and Techniques in Metal 3D Printing

HOW TO Put Innovation to Work for You