Beyond Parts: 5 Developments Reshaping the Market for Automotive Suppliers

Rapid transformation in the automotive industry is reshaping the way it does business with machine shops and other parts suppliers. Here’s what you need to know.

Rapid transformation in the automotive industry is reshaping the way it does business with machine shops and other parts suppliers. Here’s what you need to know.

The automotive industry may be transforming more rapidly now than at any other point in its history, with innovations from autonomous driving to the rise of electric vehicles and the production of highly connected cars with advanced infotainment systems.

The impact on manufacturing isn’t limited to the automakers themselves, either: Much of the change is already trickling down to all tiers of suppliers.

Machinists and sheet metal workers, for example, are learning how to process novel materials like advanced high-strength steel (AHSS) and carbon-fiber composites, each of which is crucial to lightweighting cars, a task particularly important with electric vehicles because of their heavy batteries.

Shaping such materials requires mastering advanced, often unfamiliar polycrystalline diamond (PCD) and cubic boron nitride (CBN) cutting tools, as well as becoming adept in the new processes that accompany their use.

Still, there’s much more to successfully supplying automakers than delivering metal components quickly and accurately. This article takes a step back from hands-on technical advice to look at broader business imperatives that make the difference between long-term success and failure.

Rick Crabtree, product solution manager for aluminum at Sandvik Coromant US, has a broad range of knowledge regarding the automaking sector. He’s widely experienced in discussing innovative tooling solutions for this business segment and many others but is equally knowledgeable about its various challenges.

“It’s a dynamic market,” he says. “The direction that automakers will take depends in large part on the country or region along with various geopolitical factors. For instance, car buyers in the United States have shown some initial reluctance to embrace electric vehicles due to concerns over the electrical grid and the relatively long distances they drive.”

Continuous improvement in battery production and the expansion of charging stations are key factors, not to mention battery recycling. Meeting sustainability criteria will prompt wider acceptance of EVs, too.

Europeans, on the other hand, are burdened with much higher energy costs than in the U.S. and are generally more receptive to the e-mobility movement, even in the face of similar infrastructure limitations.

And China, the world’s largest automotive market, is seeing strong governmental support for electric and hybrid vehicles to combat air pollution and reduce the country’s reliance on oil imports.

The result? Automaking and all that it entails will only grow more complex over the coming years. “We’re already seeing that some tier suppliers and machine tool builders have begun retooling to support BEV [battery electric vehicle] production,” says Crabtree, “while others are dealing with the unique demands of hybrid vehicles, where small, highly efficient engines are used to augment battery power.”

Whatever the vehicle’s method of propulsion and wherever it’s built, automakers must pursue corporate strategies—some new, others not—that will ensure long-term success for them and their employees. The methods they choose, necessarily, affect their relationships with suppliers.

Good news! There’s no need to cut profit margins to remain competitive. Manufacturers that focus on trimming as much fat as possible from their production processes stand the best chance of maintaining or even increasing profitability, and perhaps the best way to do this is through adoption of lean manufacturing principles.

Value stream mapping, 5S, Poka-Yoke (the Japanese term for error-proofing) and Kanban, to name a few, are some of the more well-known building blocks behind this decades-old child of the Toyota Production System, developed by the carmaker in the late 20th century. All serve to eliminate muda, a Japanese word that means waste, making manufacturers more profitable and efficient with minimal investment.

There’s also value engineering (VE), the practice of substituting less expensive materials without sacrificing functionality or performance. Traditionally associated with product redesign, VE also applies to manufacturing by challenging team members to rethink existing processes and look at problems with fresh, sometimes unorthodox perspectives.

Techniques such as statistical process control (SPC), failure mode and effects analysis (FMEA), and root cause analysis (RCA) both complement and support lean manufacturing initiatives.

As renowned management consultant Peter Drucker reportedly said, “You can’t improve what you don’t measure.” Using statistical process control to monitor and analyze key part metrics during manufacturing—and recording them—is an essential first step toward becoming more competitive.

Similarly, failure mode and effects analysis lets companies evaluate potential malfunctions in parts and processes alike and take actions to prevent them. And if the failure has already occurred, it’s only through root cause analysis that the cause(s) can be eliminated, avoiding future occurrences.

Going it alone is no longer an option in an increasingly complex and fast-paced manufacturing world. An emphasis on regular communication with customers, suppliers and employees goes a long way toward improving relationships and preventing potential ball-dropping.

This means clearly identifying targets and goals. Set expectations early in the relationship, document requirements and make robust supplier/customer account management a priority. Doing so will minimize miscommunication and make everyone more efficient (not to mention happier).

It will also open the door to the establishment of value-added services. For example, an automotive supplier could go well beyond the traditional “here are your parts” mentality by offering customers kitting and assembly services, custom packaging, stocking agreements (such as the Kanban inventory control system developed by Toyota), extended warranties, consulting, recycling services, and much more. Each of these helps to cement relationships and reduce or even eliminate the price concessions common in the industry.

If you haven’t noticed, the manufacturing world is adrift in innovative solutions. Everything from digital twins and artificial intelligence (AI) to blockchain and the Industrial Internet of Things (IIoT) will change how automotive manufacturers and their suppliers do business.

Manufacturers must, therefore, keep current on such developments, carefully evaluating and—when it makes sense—implementing new technologies. Progressive companies may appoint one or more “technology scouts” to monitor the competitive landscape and make sure they don’t miss opportunities, unwittingly handing rivals an advantage.

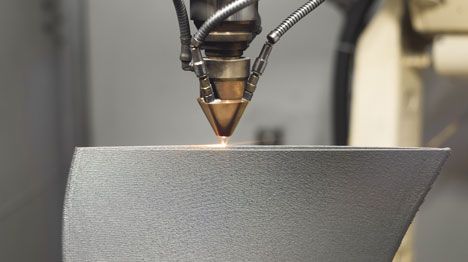

Consider the impact of 3D printing, or additive manufacturing (AM), for instance.

Early adopters found themselves able to prototype new products far more quickly than their competitors. That trend continues today.

As the capabilities of additive manufacturing increase, its reach into low-volume and even automotive-level production are growing more pronounced. Other technologies will bring similar benefits, but only to those actively pursuing such opportunities.

This last, but certainly not least, imperative follows closely on the heels of partnerships. After all, unexpected shortages in key components and raw materials are more easily avoided when strong bonds with suppliers exist. Further, actively communicating with customers about potential risks helps them to better prepare while further strengthening long-term relationships.

Supply chain mapping is a crucial step toward identifying risk areas. Doing so involves creating a visual representation of every process and entity involved in the supply chain, from raw material suppliers to end consumers.

Exercises like this help automakers and their suppliers identify vulnerabilities, understand the flow of materials and information, and make informed decisions. For instance, if a specific region supplies critical components, any disruption there can halt production globally.

Given the numerous parts and components in any motor vehicle—never mind the tooling and machinery needed to produce them—understanding where each item comes from is vital to increased sustainability, customer satisfaction and corporate profitability.

Keep in mind, this overview represents only the tip of a truly gigantic iceberg. Vertical integration, strategic alliances, reshoring and nearshoring, environmental regulations and sustainability are just a few of the big-picture topics that automakers will be thinking about over the coming years and any change at the top tends to trickle down to the manufacturing base and its suppliers.

So fasten your seat belts. It’s going to be an exciting ride.