Think long term to win the battle of total cost of ownership versus “we always want the lowest price possible.”

World-class industrial distributors of maintenance, repair and operations materials constantly face the dilemma of trying to prove to their clients that the lowest price supplier is not the lowest cost provider.

The difficulty lies in the job descriptions of the various disciplines involved in making MRO decisions. Let’s take a look:

Procurement: The performance of people in these roles depends on reporting reductions in price. Buy it cheaper, and be rewarded.

Finance: Yes, folks on the financial team want the lowest price available [not always measurable because of the high number of SKUs], but then they will argue that the company buy less. “We need to lower our inventory investment to increase our cash flow.”

Maintenance: This team must ensure that asset reliability levels keep production humming without downtime. “I need the right part in the right quantity to perform my directed duties. I don’t care about ‘low price’ or ‘lower inventory.’ I must have these critical spares when I need them or there will be massive production losses for the company.”

Engineering: Operating engineers aim to improve processes, assets and products for the company’s market. Many times the effect of their endeavors will cause inventory obsolesce and an increase in inventory through the addition of new SKUs.

It’s easy to see the potential for conflict that exists among disciplines where MRO spend and supply chain dynamics are concerned.

Yet, it is possible to apply total cost of ownership concepts and derive substantial savings. How can a company do this and still get buy-in from four departments? How can it satisfy the job requirements of each of these departments?

Here are two true stories that show how distributors sustained profitable TCO concepts for their client prospects.

TCO Mini Case Study 1: A Glove Story

A consumer goods safety distributor had been the go-to supplier of a large quantity of gloves for a manufacturing company that stocked gloves for workers on two of its production lines: lines #101 and #201. The price of the gloves was $1.50 a pair; the company’s yearly glove consumption was 12,000 pairs, for a total expenditure of $18,000.

The purchasing team decided to seek new quotes: Supplier A quoted $1.35 a pair—a 10 percent per pair savings. Supplier B, the incumbent, cut its price to $1.35 a pair to meet the competition. Supplier C asked to review the production lines to see if there were any TCO metrics that should be explored.

The company let Supplier C check out the production lines. It found that the $1.50 glove was inadequate for the job it was intended to do (personal hand protection). The review found that workers on Line #101 had been “putting up” with the poor glove quality. Meanwhile, the workers on Line #201 used two gloves at a time to achieve the needed protection.

After the line review, Supplier C suggested a better-quality glove that would cut the company’s consumption from 12,000 gloves to 8,000. The proposed price of the new glove, at $1.65 a pair, came in higher than either Supplier A or the incumbent supplier’s offer.

Let’s look at the math: 12,000 gloves at $1.35 would run to $16,200. If the company buys 8,000 gloves at $1.65, its outlay would be $13,200—a savings of $3,000, or 18.5 percent.

When compared to the current price of $1.50, the savings is more compelling: $4,800, or 26.6 percent. This change would also result in a decrease in distribution costs related to the use of 12,000 gloves. It also would likely result in a decided increase in worker efficiencies, safety and satisfaction.

The implementation of Supplier C’s new glove program satisfied all disciplines: Purchasing claimed the total savings; Finance achieved lower inventory; Maintenance moved to a reliable production; and Engineering pointed to more efficient operations. Everybody won!

To sustain the situation, it was necessary to delete the SKU number for the $1.50 glove and create a new SKU for the $1.65 glove. The uninformed could raise a fuss over the higher price without realizing that the company saved $3,000 plus had happier workers as a result of proactive productivity on the part of their TCO provider.

How can a business optimize tooling costs and make buying decisions based on TCO? Pick up pointers in this Better MRO article.

TCO Mini Case Study 2: A Drill Story

A tire manufacturer decided to outsource its MRO supply chain, including the management of its MRO storeroom distribution operation to a distributor with proven on-site MRO expertise. We’ll call the MRO distributor Flan Co.

The potential savings appeared substantial, and the tire company planned to use a series of mutually agreed-upon key performance indicators to measure data to assess total cost of ownership.

One of the MRO reports available from the tire company’s cloud-based maintenance management system tallied dollar spend, per SKU, in descending order. Flan Co. decided to drill down into the data in this report. Number 5 on the list was a SKU for a #56 drill bit, with an expenditure of $58,000. Well, that certainly looked worth investigating.

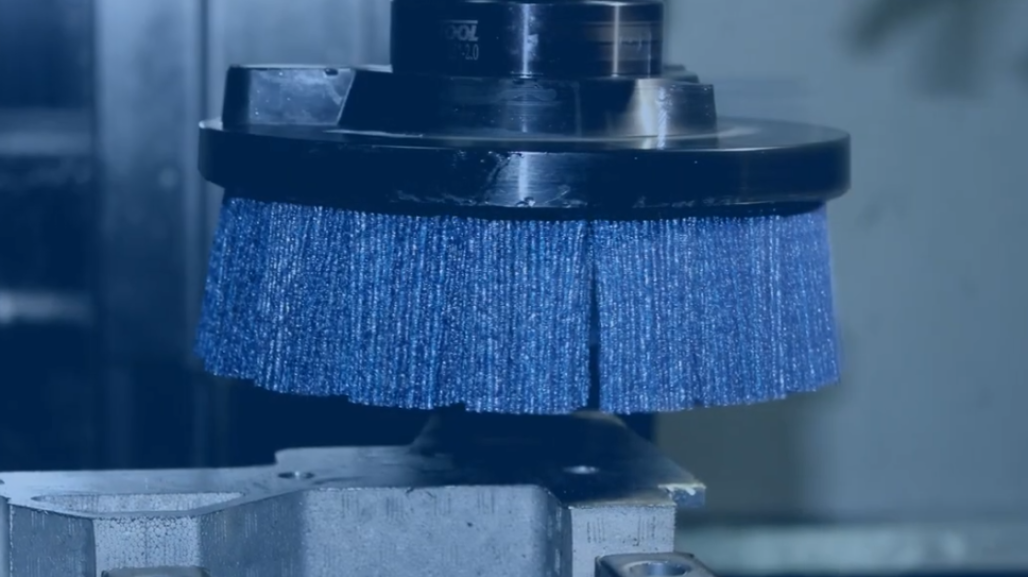

Upon review, Flan Co. found that the drill was used to vent tires during the manufacturing process. It was a common #56 high-speed bit normally used for everyday plant maintenance; it was certainly not the ideal tool for venting tires.

Flan Co. worked with its cutting tool supplier to analyze the bit’s use and recommended a high-quality tungsten bit [also #56] to replace the current high-speed bit. The price of the tungsten bit was five times higher than the current bit. But the move to the newer bit would increase the number of holes by five times. The associated savings was increased to the extent that the expenditure for the #56 bit decreased a whopping $50,000, dropping TCO from $58,000 to $8,000—plus the time saved in resetting the bits in the drill chucks.

While these two cases use relatively simple price comparisons, they reflect why it’s so important to consider TCO’s potential for even the seemingly most insignificant part. The cases also clearly illustrate that selecting the lowest price supplier does not always result in the lowest cost for the maker. And, it also helps to think about TCO in relation to revenue: Flan Co. lost $50,000 when filling a basic need for #56 drill bits.

Related Articles

Your Machine Maintenance Checklist

TOOLING UP: Ansell: HyFlex Precision Comfort Gloves with Aerofit Technology

VIDEO: Case Study: Real Results and Impact: The MSC and Catamount Partnership Story

4x Output. One Simple Switch. Osborn Customer Stories