The Right Tooling Helps Today’s Metrics and Tomorrow’s Machinists

Under pressure to crank out high-quality parts in aggressive production runs? Without the right tooling in your machine for the material, you’re probably missing the mark.

Under pressure to crank out high-quality parts in aggressive production runs? Without the right tooling in your machine for the material, you’re probably missing the mark.

Before you choose a metal-cutting tool, you need to know your goals. Use the right machine and productivity metrics to help drive your decision.

Know your rate of scrap. Producing scrap when running a machine is worse than not running it at all.

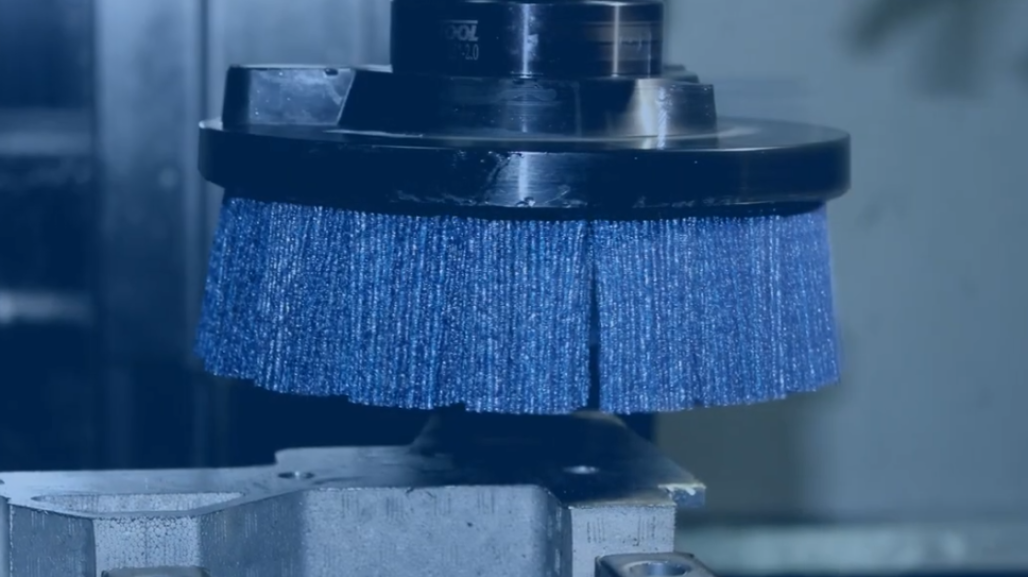

The material being machined is at the top of the list of factors that must be considered in order to select the right tools for a job.

Technology can help compensate for a shortage of machining skills. For example, new tools with embedded sensors allow users to understand how a tool is performing while it’s cutting.

A machine shop’s choice of metal cutting tools can be a big step toward achieving a shop’s productivity goals. Yet, some tooling decisions can have the opposite effect and keep objectives out of reach. Industry and academic authorities discuss the details of effective decision-making on tooling.

How can shops assess their performance in pursuit of their goals? By employing a variety of metrics that help them understand the output of their machines and the tools used in them. Important variables tracked by machine shops include cycle time, cost per hour of operation, hourly shop rate, burden rate, overhead, markup and service rate.

A key derivative of all these variables is cost per component, notes Jeff Rizzie, director of digital machining sales in the Americas for Sandvik Coromant, a manufacturer of cutting tools for metalworking equipment. Cost per component is a measure of the fixed costs (those not dependent on a shop’s production output) and variable costs (such as the cost of materials, which is related to production volume) a shop incurs when producing each component, Rizzie explains. It also takes into account cycle time and its reciprocal throughput.

In sophisticated machine shops, the focus is often on the lowest dollar cost per volume of material removed, according to Thomas Kurfess, a professor at the Georgia Institute of Technology’s George W. Woodruff School of Mechanical Engineering. To arrive at this figure, Kurfess notes, shops must determine an optimal machining rate, since the fastest possible machining time would lower machine costs but cause tools to wear out faster.

Find out your key metrics. Use our milling machine and productivity calculators.

Another important machining metric often tied to the decision of tooling is scrap rate, which is the percentage of rejected parts out of the total number of parts produced. If a machine and its tools are producing a 20 percent scrap, the owner is incurring variable machining costs but getting nothing in return 20 percent of the time. “So producing scrap when running a machine is worse than not running the machine at all,” Rizzie says.

Scrap rate factors into the determination of overall equipment effectiveness, the percentage of time a machine and tools are running and making good parts. If a machine tool is run constantly for one eight-hour shift a day and the machine is technically available 24 hours a day, the OEE is 33 percent if all parts made during that shift are good, Rizzie explains.

“But when I run the machine to produce parts that are scrapped, I haven’t added any value,” he says. So time spent producing scrapped parts with underperforming tools lowers OEE.

Learn more about OEE Calculations and Methods.

Many productivity and manufacturing metrics can be positively impacted by a machine shop’s choice of cutting tools. For example, Rizzie points out that selecting the right tool can dramatically reduce cost per component. Since cutting tools usually account for only 2 to 4 percent of the total cost per component, he notes, the purchase of a new cutting tool that boosts machining productivity by 20 percent would actually lower cost per component by about 15 percent, even if the tool costs a little more than other options on the market.

Rizzie puts the material being machined at the top of the list of factors that must be considered in order to select the right tools for a job. Important material-related situations include the amount of heat generated when machining a material, which could have an adverse impact on tools if not effectively controlled, and the abrasiveness of the material, which causes tool wear.

What if the right tooling could boost machine output? See the impact of reducing overall cycle time by one second in this infographic.

How do shops find tools that meet the challenges of a particular job and also provide the desired productivity metrics? One way is to rely on tooling suppliers, says Georgia Tech’s Kurfess, who runs laboratory tests to evaluate claims about new tools and other machining products. A tooling supplier can provide information about a product relating to speeds, feeds and depths of cut—key data that helps users determine whether the tool will meet their production requirements.

Important as the right tooling can be, more might be required to boost a shop’s machining outcomes. “It’s easy to put in more expensive and improved tooling,” Kurfess says. “But the question is, can your machine make use of that improved tooling? If the answer is no, then you have to ask if the improvement you would expect makes it worthwhile to invest in a new machine.”

As anyone knowledgeable about manufacturing can tell you, the shortage of machining skills in the U.S. is no myth. “It’s a very significant issue in organizations of all sizes and all industry sectors in manufacturing,” says Jeannine Kunz, vice president of Tooling U-SME, an educational organization for the manufacturing industry run by the Society of Manufacturing Engineers.

According to Kunz, the skills shortage in machining is in part a “pipeline issue”—that is, not enough new people are going into machining programs at community and technical colleges. This is unfortunate, she says, because machining jobs pay well and the work is challenging and interesting.

At the other end of the career spectrum is another part of the problem: the large number of machining workers who are retiring. Many of these people have reached “black art status” in machining, Kunz says. “They know the different sounds and feels of the machine, so they can evaluate what’s happening and what might be going wrong.”

To help close the machining skills gap, some suppliers are providing expertise to machine shops that a seasoned staff machinist might have provided in the past, says Kurfess, who focuses on the development of advanced manufacturing systems. Technology can also compensate for a shortage of machining skills. For example, new tools with embedded sensors allow users to understand how a tool is performing while it’s cutting.

How does this help fill the skills gap?

“Highly skilled technical machinists can tell when something’s wrong just by hearing or feeling it,” notes Rizzie, which now offers such tools. “Less skilled machinists are just not going to know. But if they have a readout [from a tool and a machine] that says something is wrong, they can make the necessary adjustments.” That isn’t to say less skilled machinists will not become more experienced over time. They will, but sensors and other emerging ‘smart’ technology can help alert problem areas as they arise.

Are you concerned about hiring a new generation of machinists? Read how John Hindman, director of learning and performance improvement at Tooling U-SME, finds real ways manufacturers can positively influence the manufacturing skills gap. Hindman explores the myths and realities of working across generations—and the importance of mentoring and succession planning.

Read all about it in the article: “How Empowering Millennials Can Help Bridge the Skills Gap.”

Looking for help with your machine’s productivity and tooling? Contact 800-645-7270 to have your questions answered by an MSC representative.