Wide-scale adoption of electric vehicles will have significant repercussions for automotive suppliers: They must shift processes and technology to serve the changing market needs. Here are three trends you need to know about.

Perhaps you saw the recent announcement from General Motors (GM), describing how chairwoman and CEO Mary Barra has committed to making the company carbon neutral at all of its facilities by 2040. As part of this move, GM will phase out production of gas and diesel-powered cars and light-duty trucks in favor of battery electric vehicle (BEV) technology by 2035.

The 112-year-old automaker will also supply Hydrotec fuel cell “power cubes” to heavy equipment manufacturer Navistar and has partnered with Honda to commercialize hydrogen fuel cells as a complement to battery-powered vehicles. Most notable of all in GM’s announcement was Barra’s call to the industry: “We encourage others to follow suit and make a significant impact on our industry and on the economy as a whole.”

Make no mistake—even without GM’s support, the BEV transformation was already well underway. Six months before Barra’s announcement, Allied Market Research predicted that the global electric vehicle market would reach $802 billion by 2027, a compound annual growth rate (CAGR) of 22.6 percent and a fivefold increase of the market’s 2019 value.

Read more: Cobots and Manufacturing: 3 Ways Collaborative Automation Can Help Your Shop

At the same time, Tesla and a fleet of startup competitors (many of them Chinese) are changing the way cars are designed, delivered and maintained. The automobile industry’s traditional two-year development cycle is accelerating, giving way to cloud-based functionality updates and rapid design iterations that were once unthinkable.

“Elon Musk makes engineering changes on the fly,” says Laurie Harbour, president and CEO of Southfield, Michigan-based consulting firm Harbour Results Inc.

“In other words, the Model Y that came out in January is not the Model Y that you can buy in the store today. They’ve improved it, in a manner not unlike how Apple pushes regular updates to the iPhone. Compare that to General Motors or one of the other Big Three—if someone there finds an improvement opportunity, the company will wait until the next model year to implement it. The people at Tesla just improve their products as they go.”

Tesla is also changing the way it makes cars. One notable example of this is CEO Elon Musk’s investment in eight Giga Press die-casting machines from the Idra Group in Italy—the biggest in the world—which the automaker will use to produce single-piece aluminum castings for the Model Y underbody.

Read more: 5 Ways Manufacturers Can Use Data Analytics to Improve Efficiency

“This is a big deal,” Harbour says. “There will be one large die-cast component for the battery tray under the seats, and the area where an engine compartment would normally sit will also be die-cast. I’m told that Tesla will eliminate roughly half of the body shop with this investment, along with 1,000 or so stamped parts per vehicle. Tesla workers will be able to bring three die-cast components to the main production line, assemble them to the drivetrain, and drop the body on top.”

What does all this mean to the automotive industry? More importantly, what does it mean to the Tier suppliers who deliver millions upon millions of machined and fabricated components each year to automakers? In a word: plenty. Aside from tooling up for a whole host of new vehicles, these shops must brace themselves for unrelenting and increasingly rapid change as fossil fuels give way to electric power and automakers continue their push for ever smarter, lighter (and often autonomous) vehicles.

Here are three parts of the shop floor that will be most affected:

Manufacturing Trend No. 1: Cutting Tools

One big change will come in the form of advanced materials. Yes, aluminum will continue to play a key role in making cars lighter, but there will also be plenty of CFRP (carbon-fiber reinforced plastic) and other composite materials coming onto the automotive scene.

Unfortunately, these materials are both abrasive and prone to fraying, splintering and delamination. As discussed in Better MRO’s How to Improve Time in Automotive Machining, polycrystalline diamond (PCD) and so-called “veined” diamond cutting tools will be a key part of being competitive with composites as their use increases. That story also mentioned the increased use of compacted graphite iron (CGI), stainless steels and high-strength steel alloys as a means to reduce vehicle weight, all of which will require that machine shops embrace material-specific carbide, ceramic or polycrystalline cubic boron nitride (PCBN) tooling. Doing so will produce the lowest cost per part, even though the cutting tools themselves are relatively expensive.

Read more: 5 Future Trends Driving Growth in Medical Device Manufacturing

Manufacturing Trend No. 2: Machine Tools

The words “automotive” and “high-production” have long been synonymous, and battery-powered vehicles or not, that’s unlikely to change. As a result, multi-spindle screw machines, transfer lines and automated stamping and welding cells will continue to produce the lion’s share of most high-volume automotive components.

However, production quantities will likely fall somewhat as BEV use ramps up and vehicles with internal combustion engines (ICE) gradually go the way of 50-cent-a-gallon gasoline, opening the door to shops with the sophisticated Swiss-style CNC lathes as described here.

Though often associated with medical machining, these flexible machine tools are usually equipped with fast spindle speeds and generous cutting tool stations and can perform multiple machining operations simultaneously. This makes them well-suited for the higher volumes common in the automotive space, especially when their owners invest in the magazine-style bar feeders and tool breakage detection needed for lights-out manufacturing.

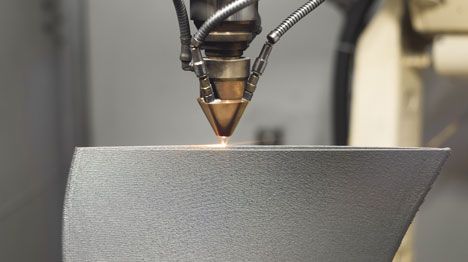

Manufacturing Trend No. 3: 3D Printing and Additive Manufacturing

Though long considered a “prototype-only” technology, 3D printing is gradually becoming a player in the manufacturing market. HP, for example, advertises its Metal Jet and Multi Jet Fusion printers as capable of producing high-volume, low-cost parts in metal or plastic, and even touts its use by Volkswagen and other automakers.

That said, one of 3D printing’s biggest benefits for many manufacturers—automotive or otherwise—is its ability to quickly produce low-cost machining jigs, assembly fixtures, robotic grippers, press brake dies and other tooling for the factory floor. This is especially true given the wide assortment of engineering-grade polymers such as fiber-filled composites, Ultem and PEEK. These and other materials give engineers wide latitude and extreme flexibility, not only for tooling purposes but for the design of functional prototypes.

Read more: Additive Manufacturing: 5 Things You Need to Know About 3D Printing

Additive manufacturing (AM) is also growing popular within the casting industry, where it’s used to build cores and molds, as well as the printing of metal inserts for use in plastic injection molds.

Given the rapid pace of change in all manufacturing sectors, automotive among them, it will be more important than ever for machine shops, sheet metal fabricators, electronics manufacturers and others to develop fast and flexible manufacturing processes.

Established shop floor tools such as offline presetting, in-process machine probing, and zero-point workholding systems will pave the way, followed by the use of software simulation and the digital twin. Both will help to streamline machine programming and engineering tasks, while IIoT-enabled machine analytics will serve to optimize cutting tool usage and machine uptime. It’s all there for the taking. All that manufacturers have to do is get in and drive.

Related Articles

The Latest Tools and Techniques in Metal 3D Printing

HOW TO Put Innovation to Work for You

VIDEO: HOW TO Implement Grinding Solutions with Automation

Smart Restrooms: Companies See Value in IoT Connected Dispensers