The future of passenger vehicle powertrains is electric. Here’s how widespread adoption of electric vehicles, or EVs, will significantly affect the cutting tool industry.

It may have once seemed like a distant prospect, but rising concerns about climate change and sustainability are making the greater adoption of electric vehicles, or EVs, a soon-to-be reality.

Large automakers such as General Motors, Ford and Volkswagen are pouring billions into developing electric and autonomous vehicles, and the Biden administration has called for $174 billion in government spending to boost EVs, including $100 billion in consumer incentives.

The move away from cars powered by an internal combustion engine (ICE) will affect the cutting tool industry in many areas, including the number of components needed in the new EV drivetrains, the structure of supply chains and changes to established business models.

Cutting tool makers and automotive industry suppliers are most at risk from the shift to EVs. What, then, can industry players do to adapt?

Here are three areas for manufacturers and suppliers to adapt and stay competitive—for example, focusing on additive manufacturing techniques or customized solutions, or diversifying into industries with similar machining requirements.

Read more: Career Spotlight: How Do I Become a CNC Programmer?

No. 1: New Parts for Electric Vehicles

The change from internal combustion engines to electric motors will be one of the most significant the automotive industry has faced.

After a century of investment, development and refinement of the ICE, automakers will begin to accelerate development of electric drivetrains, which will mean a reduction in the number of components used. Parts such as exhaust systems, valves, crankshafts and engine blocks will no longer be required in an EV world.

This will significantly affect cutting tool manufacturers and suppliers that depend on the automotive sector, since they have historically relied heavily on the ICE machining market. As the need for these products slows, there may not be significant demand to sustain the current number of players in the cutting tool market.

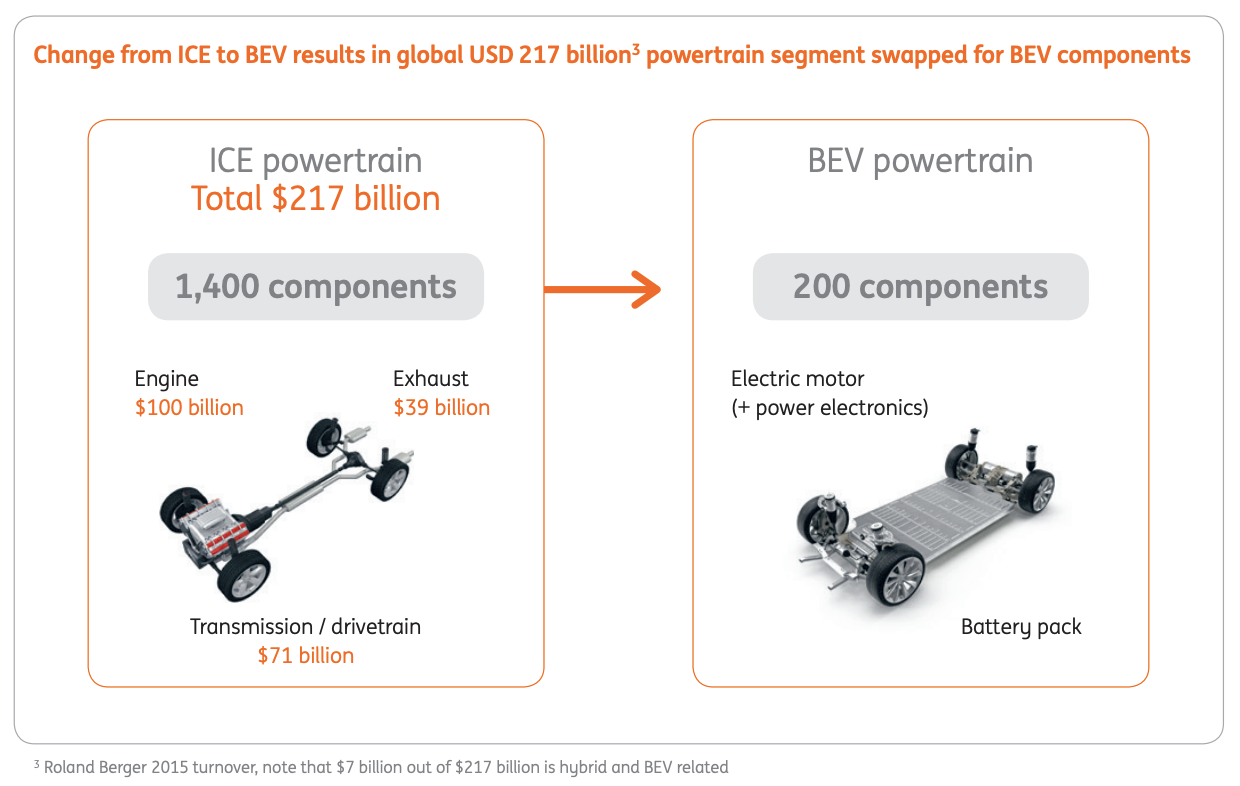

According to an analysis by global bank ING, an EV’s powertrain contains about 200 components, while a typical four-cylinder ICE has about 1,400 components—a parts reduction of 86 percent.

“Exhausts, transmissions and engine components are exchanged for electric motors, battery packs and power electronics (to control electric power),” ING notes. “Almost a third of the value of the automotive supply chain is powertrain related and threatened by the shift to electric powertrains.”

What should suppliers and tool manufacturers focus on? Electric vehicles will need new components, so the production of items such as battery casings and EV charging ports could present a growth opportunity.

Also, with cutting tools essential for industrial manufacturing processes, suppliers should examine opportunities presented by new developments in the industry, such as automation, energy efficiency and the building of lightweight parts.

Read more: Automotive Industry Trends: 3 Things to Watch for in Electric Car Manufacturing

No. 2: 3D Printing and Additive Manufacturing

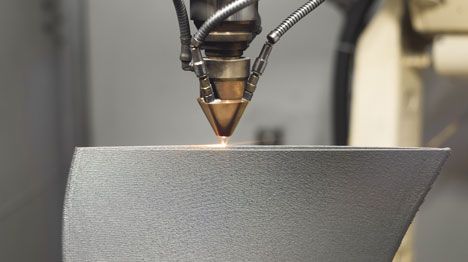

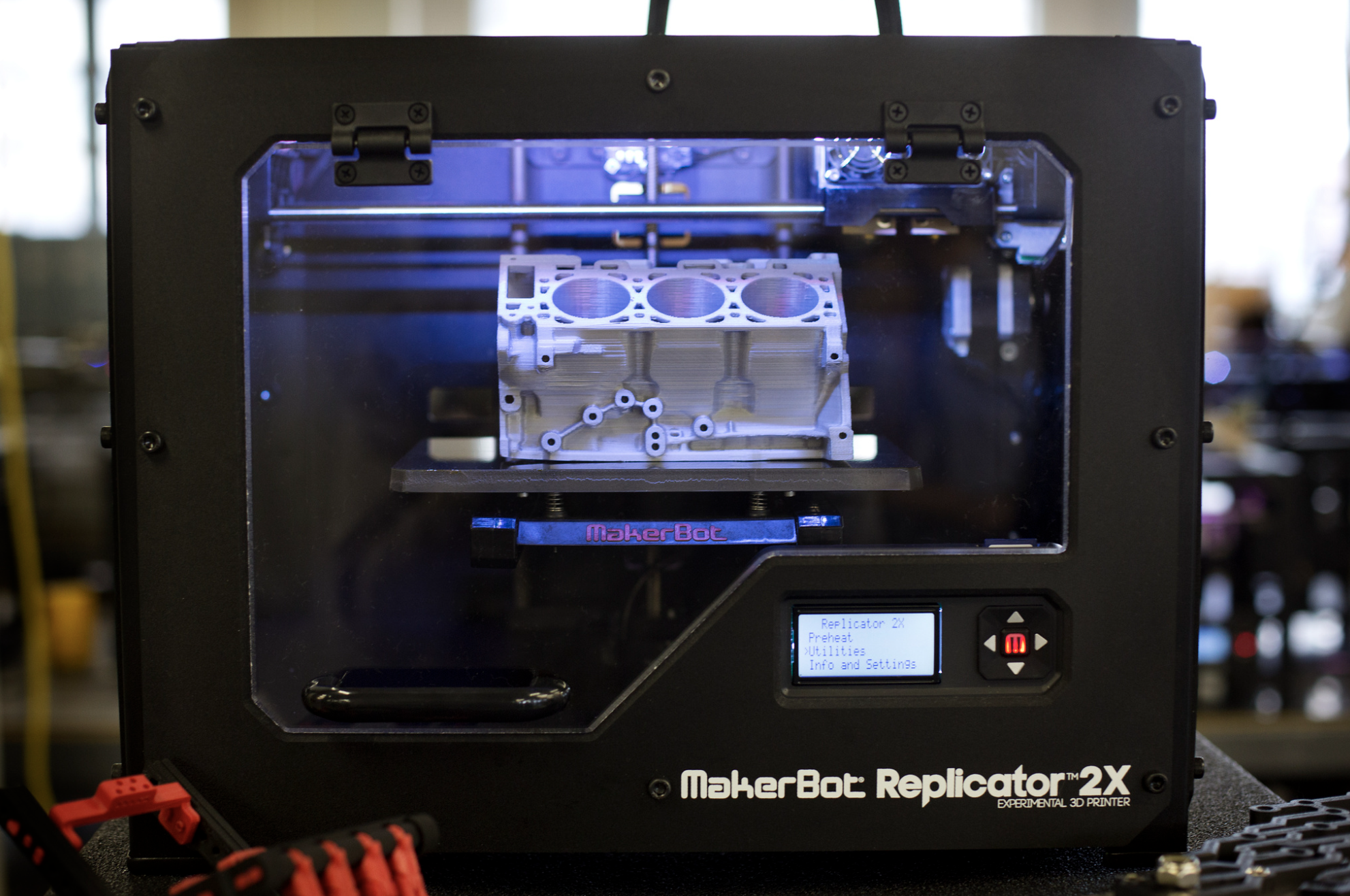

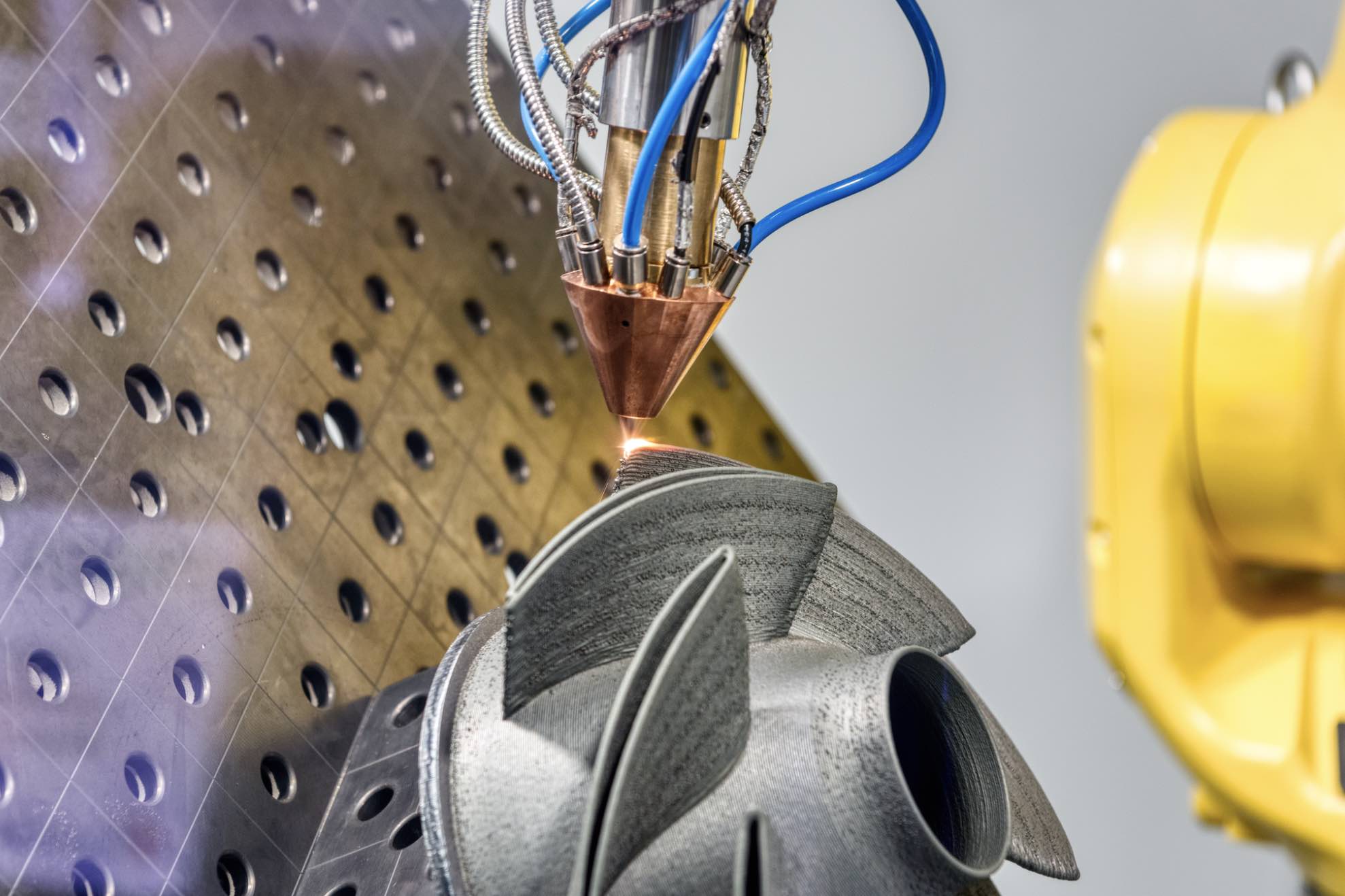

Another trend that may be a significant factor in the switch to electric vehicles is industrial 3D printing or additive manufacturing.

The technology has grown from being primarily a rapid prototyping technology to a commonly used production tool for parts such as fuel nozzles and aircraft engine turbine blades, dramatically shortening the supply chain by eliminating several steps in the production process. Recent reports estimate the global market for additive manufacturing will have a compound annual growth rate of about 25 percent.

The intrinsic capabilities of the additive manufacturing process make it a good fit for EV part production.

Chief among the inherent capabilities of additive manufacturing is the ability to make parts lighter, which can be important in EV development. Lightweighting vehicles can make them more fuel-efficient and improve the distribution of weight on a vehicle’s axles, which can help improve battery life.

Additive manufacturing allows high levels of customization and the creation of parts with intricate structures that can’t usually be achieved using conventional manufacturing processes. This translates to the elimination of material from a part, reducing its weight and sometimes making it stronger.

Additive manufacturing also allows the use of lighter materials instead of metal, and the possibility of low-cost, low-volume production.

Additive manufacturing doesn’t require heavy tools or mold changeovers, cutting the time and cost of production.

Read more: Additive Manufacturing with Industrial 3D Printing: Post-Processing Success Strategies

No. 3: Customization and New Components

The trend in manufacturing away from standardization of components and toward customized solutions is likely to be enhanced by the rise of EVs.

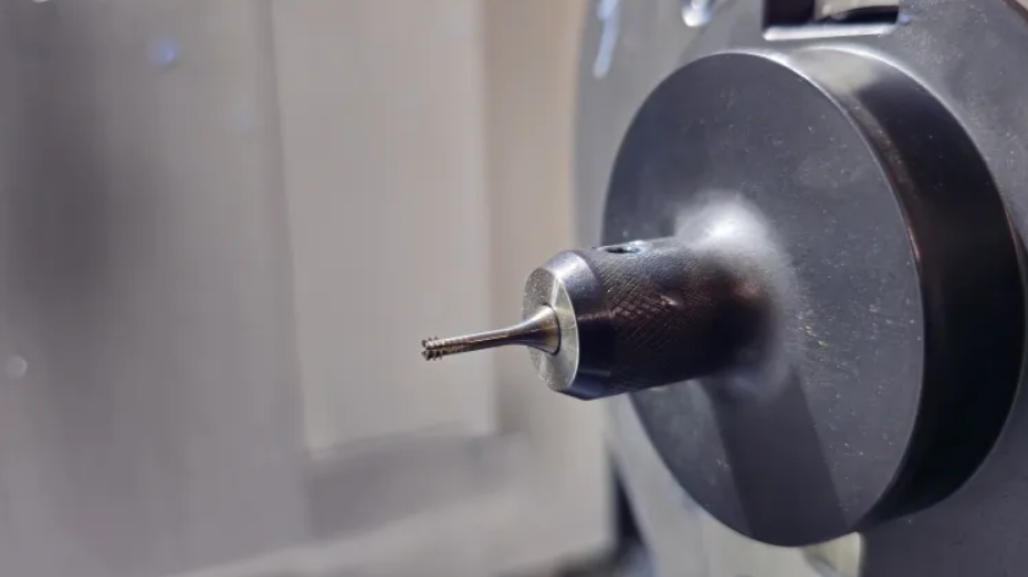

In the past, drills and other cutting tools used in manufacturing were standardized, helping industry players avoid dependence on any one supplier for parts. Today, with the use of new materials such as composites becoming more popular, the trend is toward custom solutions.

That means, for example, using high-quality customized polycrystalline diamond (PCD) tools to machine aluminum and lightweight alloy parts reliably and cost-effectively.

As the automotive industry moves toward greater adoption of EVs, it will increasingly require specific, high-quality parts to meet the industry’s changing demands.

For example, vehicle brakes will need to be stronger to accommodate the greater weight of an EV and its large battery.

Or the mass production of electric motors and EV charging stations will provide an opportunity to develop new production and machining methods to create new parts.

Industry players may also consider diversifying their offerings to serve other industries with similar component requirements as they move toward electric drivetrains, including those that produce commercial trucks, farm equipment, military vehicles, aircraft and locomotives.

Read more: 5 Ways Manufacturers Can Use Data Analytics to Improve Efficiency

What steps are you taking to accelerate your electric vehicle production capabilities? Share your thoughts and insights in the comments below.

Related Articles

Your Machine Maintenance Checklist

Instrument Calibration and Why It Matters

Collets Explained: A Guide to Types, Applications and Proper Selection

Zero Scrap and Performance Upgrade